It isn't Hillary's fault, of course. What happened to those white men without a degree is represented by this set of facts about our government:

Simply, as reflected in federal social policy the balance of power in our federal government during the time that Baby Boomers started voting shifted from progressive to conservative in 1995..

What you notice is that the Democratic Party lost the House of Representatives in the 1994 election.

Also in 1994 the first "smartphone" marketed to consumers was introduced by BellSouth as the Simon Personal Communicator.

Of course the advent and evolution of the smartphone in no way relates to or reflects the social policy changes that began with the 104th Congress. Or does it? Maybe the changes since 1994 all reflect who we have become as a people.

And perhaps nothing reflects the "Ugly American Second Gilded Age" more than the smartphone, particularly the iPhone, as shown in these pictures of bright shiny objects, who profits from them, who pays for them to have fun with them, and who the money harms:

In fact, in order to use an iPhone (and most other portable devices), the Ugly American living in our Second Gilded Age pays to injure, sicken, and kill adults and children in the Congo.

And unlike how easily many smartphone owners instantly spot a dangerous lie from Donald Trump, because it benefits them, they choose to see no similarity between Trump and Apple even though when challenged on this:

Apple, in response to questions from The Post, acknowledged that this cobalt has made its way into its batteries. The Cupertino, Calif.-based tech giant said that an estimated 20 percent of the cobalt it uses comes from Huayou Cobalt. Paula Pyers, a senior director at Apple in charge of supply-chain social responsibility, said the company plans to increase scrutiny of how all its cobalt is obtained. Pyers also said Apple is committed to working with Huayou Cobalt to clean up the supply chain and to addressing the underlying issues, such as extreme poverty, that result in harsh work conditions and child labor.She then went to brunch. To learn more about this click on the picture below...

...or grab your existing phone and find a cute cat video.

But the problem doesn't stop with harming others to get your new smartphone, as indicated in the slide show it continues with the ultimate "environmentally safe" disposal of your old phone (or the phone you gave your kid the last time).

Discarded electronics of all kinds are dangerous as explained in Toxins Found in E-Waste. Again most of the Ugly Americans living in our Second Gilded Age in Donald Trump style choose not to deal with the truth. To learn more about this click on the picture below...

...or maybe that cute cat video would be more interesting because if you enjoy it enough maybe these nice folks won't have died for you in vain.

In fairness to Apple, the company does have a major program to collect its old phones as reflected in How Apple recovers millions in gold from recycling old iPhones and iPads. But, of course, you have to participate in the Apple program.

Which brings me to what historians refer to as "The Gilded Age"in the United States which began after the Civil War and ended shortly after the beginning of the 20th Century when Progressive President Teddy Roosevelt started breaking up corporations.

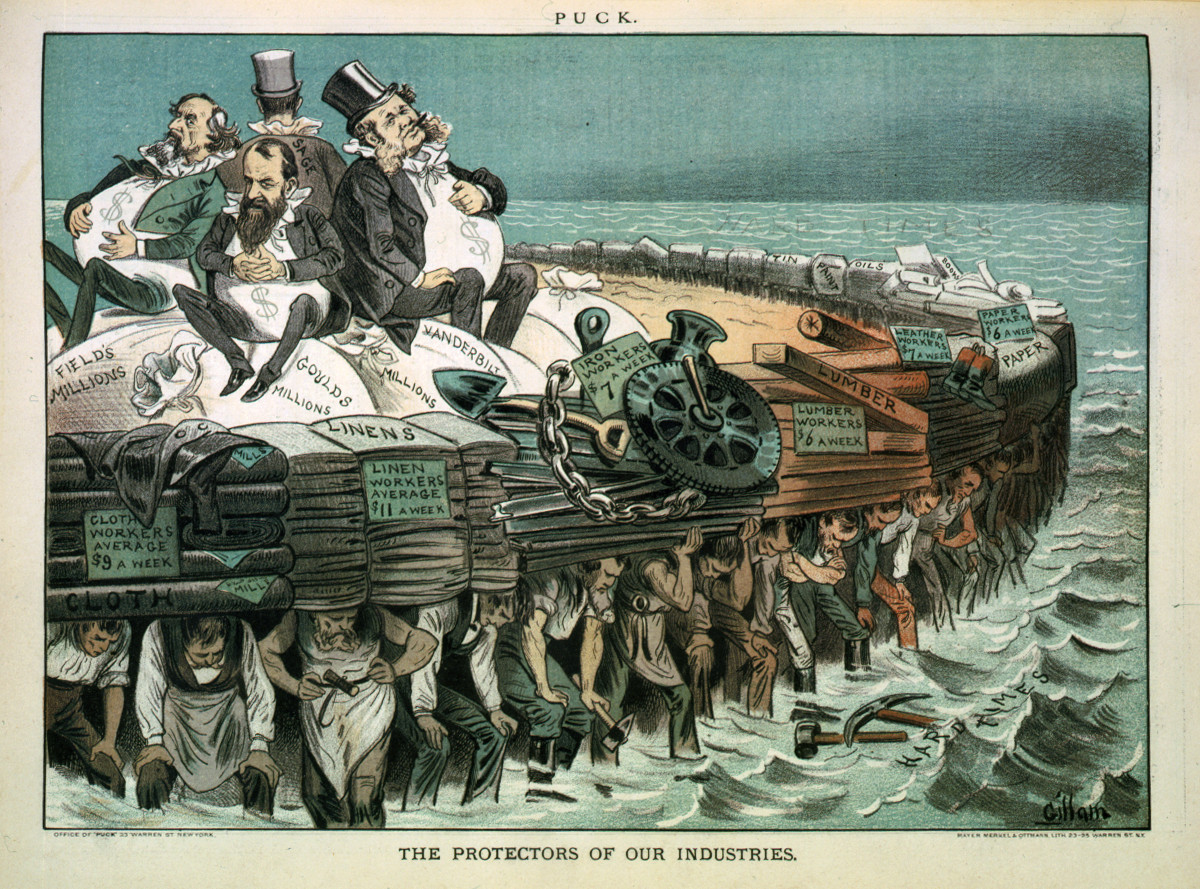

The term came from one of Mark Twain's novels, The Gilded Age: A Tale of Today (1873) (available as a 99¢ Kindle Book). The book (co-written with Charles Dudley Warner) satirized the promised "golden age" as an era of serious social problems masked by a thin gold gilding of economic expansion. It is a pejorative term used to describe a time of materialistic excesses of Robber Barons combined with extreme poverty.

The "Robber Barons" characterized in the image as sitting on the backs of workers were the 1% of the time.

Beginning in the early 2000's writers have started talking about a "Second Gilded Age." Consider the discussion from The Second Gilded Age: Has America Become an Oligarchy?:

The Occupy Wall Street movement is just one example of the sudden outbreak of tension between America's super-rich and the "other 99 percent." Experts now say the US has entered a second Gilded Age, but one in which hedge fund managers have replaced oil barons -- and are killing the American dream.However, this analogy breaks down some when you consider the fact that the American economy became a "consumer economy" after WWI (meaning that over half of the GDP is in consumer spending, as opposed non-consumer spending such as industrial equipment, retail store shelving, farm tractors, etc.). That shift is significant.

In a book published in 2010, American political scientists Jacob Hacker and Paul Pierson discuss how this "hyperconcentration of economic gains at the top" also existed in the United States in the early 20th century, when industrial magnates -- such as John D. Rockefeller, Andrew Carnegie and J. P. Morgan -- dominated the upper stratum of society and held the country firmly in their grip for years.

And "hedge fund managers" have not replaced oil barons. Hedge fund managers are part of a group called "bankers" who are all just like 19th Century banker/financier J.P. Morgan.

Comparability in corporate impact 100 years later would have Andrew Carnegie's Carnegie Steel Company and John D. Rockefeller's Standard Oil Company analogous with Apple, Mark Zuckerberg's Facebook, and Larry Pages's Google. But steel and oil in the 19th Century were not mass market consumer targeted products. No one got up in the morning and instantly grabbed a piece of steel purchased from Carnegie to access a Standard Oil pipeline like a 21st Century iPhone owner might check their Facebook Page and Google News.

The problem with comparing the two eras is the change in the nature of the economy. Outside the banking industry, we members of the general public with our individual decisions control who gets to be a "21st Century Robber Baron." Yes, many of us are manipulated by the gilding on an otherwise mundane product we choose to purchase such as the gilding of iPhones. But at no other time in history has the average

It appears we have reached the point that our spending choices, which we knew were enriching the 1%, are now an international worry.

The International Monetary Fund (IMF), which has its own set of controversies (see Wikipedia) and provides the basic support for world trade in total conflict to Donald Trump's isolationist proposals, in June released a "working paper" on Income Polarization in the United States which offers an analysis on the increased polarization of the American economy leading to a conclusion that polarization has reduced American consumer spending by more than 3 percent or about $400 billion annually. The following extracted from the paper explains the core of what they learned

The paper uses a combination of micro-level datasets to document the rise of income polarization—what some have referred to as the “hollowing out” of the income distribution—in the United States, since the 1970s. While in the initial decades more middle-income households moved up, rather than down, the income ladder, since the turn of the current century, most of polarization has been towards lower incomes. This result is striking and in contrast with findings of other recent contributions....The point is that the "Second Gilded Age" in the United States is now resulting in less consumer spending because of increased income polarization which is depressing the economy and in doing so actually reduces the "gilding." What the authors of the IMF study didn't do is project how long this can continue before the post-WWI "consumer economy" collapses.

This paper also examines the macroeconomic consequences of increased polarization, notably on aggregate consumption. We first estimate the marginal propensity to consume out of permanent income changes (MPCP) for the low-, middle-, and high-income brackets and show that these have somewhat decreased in recent years, signaling less responsiveness of consumption to permanent income shocks. Then we apply these MPCPs to income brackets, keeping income growth the same (at the aggregate level) for all brackets. This aggregate consumption then is compared to the counterfactual of consumption with constant MPCPs and bracket sizes at the initial year’s levels. The cumulative difference of these two estimates of consumption, would be the lost consumption, which is partly due to changes in consumer behavior and partly due to higher polarization.

The results are shown in Figure 17. We have shown the effect of the first force on consumption in the blue bars and the net effect of the second and third forces in green bars. The total impact has been a lower level of aggregate consumption by around 3½ percent at the end of the sample (Figure 17). This effect is split equally between lower MPCPs and lower median income levels. The size of the lost consumption is relatively large. It is equivalent of more than one year of consumption, based on historical averages, in 15 years.

...Our main conclusions, which are robust to different definitions of the middle-income and different household characteristics, are as follows:

- Income polarization has risen substantially in the past four decades—much the same, if not even faster than inequality. While in the initial decades more middle-income households moved up, rather than down the income ladder, since the turn of the current century, most of polarization has been towards lower incomes.

- The hollowing out of the middle-income class and lower MPCPs have lowered consumption. The total effect has been a lower level of aggregate consumption by around 3½ percent (relative to the counterfactual where polarization had remained at 1998 levels) at the end of the sample. This is equivalent to more than one year of consumption.

But they suggest some future studies noting: "The answers to these questions would have strong implications for fiscal policies, and in particular tax/transfer multipliers." That is one way of saying they think that income redistribution through a more progressive income tax system might in the long term avoid the collapse of the consumer economy.

What's startling about this is that the IMF appears to be worrying about "1st World" economic trends as epitomized by the situation in the United States, as reflected in these graphs:

These graphs don't tell us much that we didn't know, or shouldn't have already known. These statements aren't startling:

While during 1970-2000, more of the middle-income households moved into high- rather than low-income ranks, since 2000, only a quarter of one percent of households have moved up to high income ranks, compared to an astonishing 3¼ percent of households who have moved down the income ladder (from middle to low income ranks.)And by the way, replacing your cell phone every year or two has resulted in a toxic environmental mess harming children in third world countries. That kind of behavior in the First Gilded Age was pretty much limited to the Robber Barons. It makes one pause a moment to wonder who is sitting on the backs of whom in this Second Golden Age.

Figure 5 shows that income shares of the middle- and high-income classes were broadly similar at levels slightly shy of 50 percent of total until late 1970s. Since then, however, these shares have been diverging. Currently, the high-income class holds about 60 percent of total income, while the middle-income class holds only about 35 percent. The income share of the low-income class has been stable at about 5 percent of total for the entire sample of 1970-2014.

Perhaps it could be that we are symbolically spreading gold flakes over the e-waste to avoid confronting the fact that America depends upon the international economy to provide us with extremely low paid workers to produce not only our shiny electronic toys but necessities such as food and clothing. If we are honest, we would acknowledge that we have moved from this...

...to this...

...so we save on clothing to buy these...

...so we can enjoy our lives as Ugly Americans in a Second Gilded Age.